The Sunk Cost Spiral: Why 'Good Money After Bad' Destroys Bankrolls

James White

Co-Founder of HotTakes

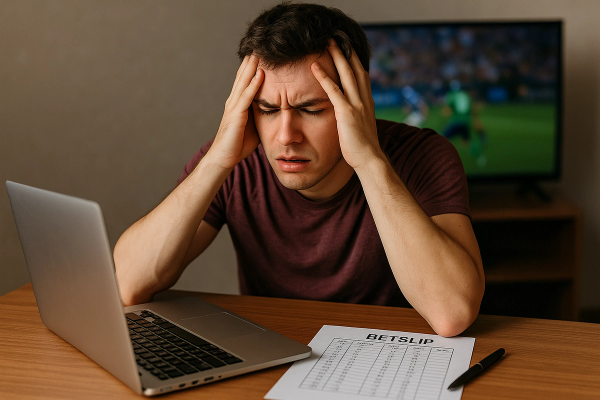

You're down $300 on a three-team parlay when the final leg, a "sure thing" Monday Night Football under, starts falling apart in the third quarter. The score's already hit 28-21, but your brain starts doing that thing: "I've already put $300 into this. I can't just let it die. Maybe I hedge with the over, or double down on another under tomorrow to get even."

Sound familiar? You just walked straight into the sunk cost spiral, one of the most destructive psychological traps in sports betting. That $300 isn't an investment you need to protect anymore, it's already gone. But your brain treats it like debt you can somehow pay back with more bad decisions. Here's why "good money after bad" is the fastest way to destroy your bankroll.

The Psychology of Throwing Good Money After Bad

The sunk cost fallacy tricks your brain into believing that previous losses justify additional risk. When you've already invested time, money, or emotional energy into something, walking away feels like admitting total failure. So instead of cutting losses, you escalate commitment, convincing yourself that the next bet will somehow validate all the previous ones.

This psychological trap gets even more dangerous in sports betting because each new wager feels like it's connected to the last one. Your brain creates narratives: "If I can hit this next bet, I'll be back to even on the week." But here's the brutal truth: every bet you place is an independent decision with no connection to previous results. Your bankroll doesn't care about your emotional attachment to past losses.

Recent studies show that bettors increase their average wager size by 65% when trying to recover from significant losses, while their win rate actually drops by 18% due to emotional decision-making. You're literally betting bigger on worse spots because your psychology is compromised.

Why Your Brain Betrays You in Losing Situations

The Escalation Trap

Professional poker players call it "throwing good money after bad," but psychologists have a more technical term: escalation of commitment. Once you've invested in a losing position, your brain starts treating additional investments as logical rather than emotional. "I'm already in for $500, what's another $200 to try to get it back?"

This connects directly to the patterns we've explored in our analysis of how worst losses lead to even worse decisions. The same emotional triggers that drive revenge betting also fuel the sunk cost spiral, creating a double trap that destroys bankrolls faster than any bad beat.

The escalation typically follows a predictable pattern: initial loss leads to "recovery" bet, which leads to bigger "make-up" bet, which leads to desperate "get-even" bet. Each step feels justified by the previous investment, but you're actually just digging deeper holes with each decision.

The Narrative Illusion

Your brain loves stories, and losing streaks create compelling narratives about "being due" or "turning things around." Instead of treating each bet as an independent decision with its own expected value, you start viewing your betting as chapters in a larger story where the hero (you) eventually overcomes adversity.

This narrative thinking prevents rational evaluation of individual opportunities. As we've discussed in our exploration of when too much research kills your edge, emotional decision-making often masquerades as analytical thinking. You'll spend hours researching a "recovery" bet that you would normally skip, convincing yourself it's due diligence when it's actually sunk cost justification.

The Professional Approach to Cutting Losses

The Stop-Loss Discipline

Professional traders and sharp bettors use predetermined stop-loss rules that remove emotion from loss-cutting decisions. Before you start any betting session, establish clear limits for both individual bets and total exposure. When you hit those limits, you stop. No exceptions, no "just one more" attempts.

The key is setting these rules when you're thinking clearly and profitable, not when you're emotionally compromised after losses. Write down your stop-loss thresholds and stick to them religiously. This prevents the sunk cost spiral from ever starting.

The Independence Framework

Train yourself to evaluate every potential bet as if it exists in isolation. Before placing any wager, ask yourself: "Would I make this bet if I hadn't lost money earlier today/this week/this month?" If the answer is no, you're not betting on value, you're betting on sunk cost psychology.

This framework helps break the narrative connection between past losses and future decisions. Your bankroll's history should inform your risk management, but it shouldn't influence your evaluation of individual opportunities. Smart money treats each bet as the first bet they've ever made.

The Cooling-Off Protocol

Implement mandatory cooling-off periods after significant losses. Professional bettors often use 24-48 hour breaks after dropping more than 5% of their bankroll in a single session. This time allows emotional systems to reset and logical evaluation to return.

During cooling-off periods, avoid checking lines, reading betting content, or engaging with anything that might trigger the urge to "get even quickly." The opportunities will still be there when you return with clear judgment. This connects to insights we've shared about why hot streaks lead to cold reality checks, where emotional extremes in either direction compromise decision quality.

Advanced Loss Management Strategies

The Bankroll Segment Method

Divide your bankroll into segments with predetermined purposes. When one segment is exhausted, you're done with that type of betting until the next period. This creates natural stop-losses that prevent the sunk cost spiral from consuming your entire bankroll.

For example, allocate separate amounts for NFL sides, NBA totals, and player props. When your NFL sides allocation is gone, you don't "borrow" from other segments to keep playing. This segmentation prevents losses in one area from creating emotional pressure to recover through increased risk in another.

The Value Audit System

Before making any bet during a losing period, conduct a strict value audit. Rate the opportunity from 1-10 based purely on expected value, independent of your recent results. Only bet on opportunities rating 7 or higher. This prevents mediocre spots from looking attractive simply because you need to "get something back."

This systematic approach builds on principles we've explored regarding market inefficiencies that sharp money exploits. True value exists regardless of your personal betting history, and recognizing genuine opportunities requires emotional discipline.

The Progressive Recovery Plan

If you must attempt to recover losses, do it systematically over time rather than through desperate large bets. Set modest weekly recovery targets (maximum 20% of losses per week) using only your highest-confidence plays. This approach acknowledges the psychological need to recover while preventing catastrophic escalation.

Remember that attempting any recovery violates pure bankroll management principles. The mathematically optimal approach is treating past losses as irrelevant and continuing with your normal betting process. But if you can't achieve that level of emotional discipline, structured recovery is better than spiral escalation.

Practical Takeaways

The next time you feel tempted to chase losses with bigger or more frequent bets, remember that sunk costs are already gone and can't be recovered through additional risk. Set predetermined stop-loss limits before you need them, evaluate every bet independently of previous results, and implement cooling-off periods after significant losses to reset your emotional state.

Professional bettors know that preserving capital during losing periods is more important than attempting to recover quickly. The opportunities that create long-term profit don't disappear because you had a bad week. Discipline during downturns separates sustainable players from those who spiral out of control.

Bottom line: Your worst betting decisions happen when you're trying to fix previous bad decisions. The money you've already lost is gone forever, but the money you're about to risk still belongs to you. Treat it accordingly.

Ready to build the mental discipline that turns controlled losses into long-term success? Join HotTakes, where your systematic approach gets recognized, your disciplined strategy gets amplified, and your professional mindset gets rewarded.